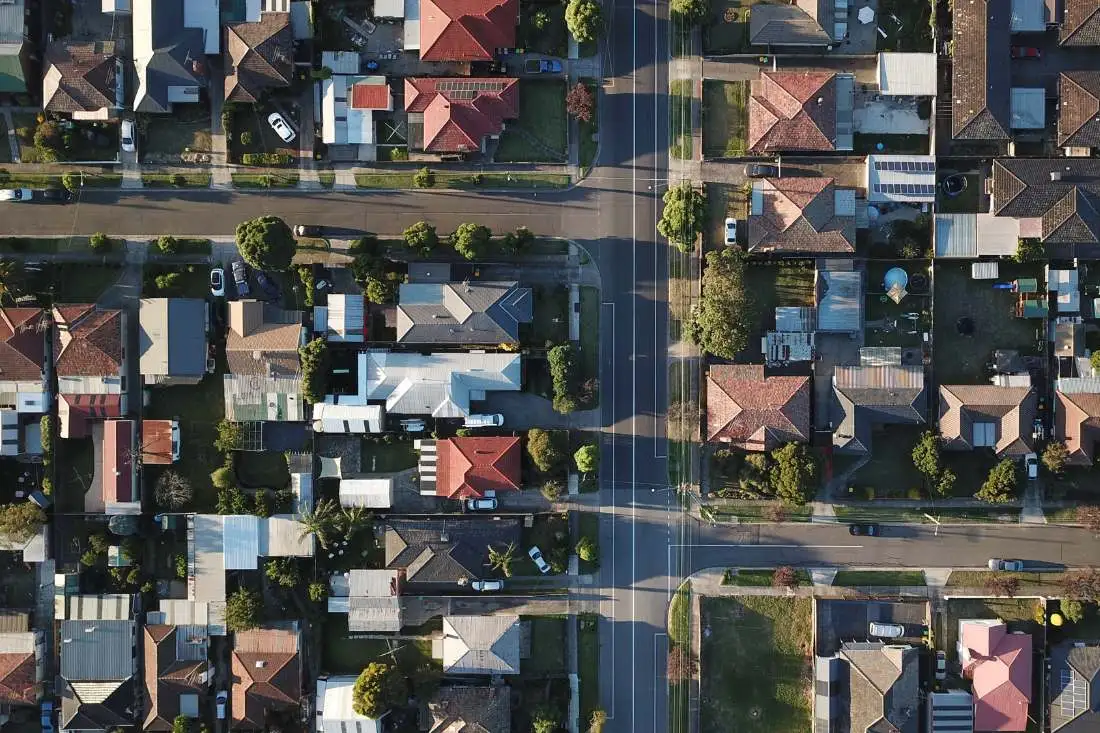

What’s tipped for house prices in 2024?

If buying a home is at the top of your wish list for 2024, don’t miss our rundown on how the property market has fared in 2023 – and why this year is shaping up as potentially another big year for real estate.

As we welcome in 2024, let’s take a quick rear mirror look on how home values moved over the past 12 months.

In a year that saw five official rate hikes, and a cost of living squeeze thanks to high inflation, home prices still jumped by 7% nationally.

Several cities eclipsed those gains, with double-digit price growth in Sydney (up 10.2%), Brisbane (10.7%) and Perth (13.5%).

But it wasn’t just price growth that took everyone by surprise.

The speed of home sales was also astonishing, with plenty of suburbs in Perth, Sydney, Brisbane and Melbourne selling houses in as little as eight to 25 days on average.

Speak with Finance Broker Melbourne today about the latest home sales in your city.

Will property values keep rising in 2024?

Well, higher interest rates are starting to take a little heat out of the market.

According to CoreLogic, home values across Australia rose 0.6% in November – the smallest monthly gain since early 2023.

But here’s the rub.

The factors that pushed prices higher in 2023 are still in place, and plenty of experts are tipping house prices will keep rising in the new year.

Three factors that could drive prices higher

Three main drivers look set to support house price growth in 2024, including:

1. Strong population growth: Population growth is rebounding strongly, driven by high immigration levels. More people generally means more demand for housing.

If you’re not convinced, a recent Domain report says “unprecedented” population growth will exert “extraordinary upward price pressure” on the property market.

2. A housing undersupply: On the supply side, we’re just not building enough new homes.

Australia’s housing shortage made headlines through 2023, and it doesn’t look like it’ll get better any time soon. Building approvals for new homes are reported to be well below average levels.

3. A rental market that’s as tight as a drum: Anyone looking for a rental can face an uphill battle. Vacancy rates are at record lows, making rental conditions tough.

This could encourage more people to buy a place of their own through one of the government’s low deposit buying schemes.

The First Home Guarantee scheme for instance, lets first home buyers get into the market with just a 5% deposit and zero lenders mortgage insurance.

Speak with Finance Broker Melbourne today about the first home guarantee scheme

Price growth is expected to be (slightly) lower next year

Most experts are tipping house prices will keep rising in 2024 though maybe not at the breakneck speed seen nationally in 2023.

That said, price growth won’t be anything to sneeze at.

Domain is forecasting house prices to jump 5-7% nationally, and in each capital city by:

– 7-9% in Sydney

– 2-4% in Melbourne

– 7-8% in Brisbane

– 6-7% in Perth

– 7-8% in Adelaide

– 3-5% in Canberra

– 2-4% in Hobart

The bottom line is that we could be facing another bumper year of price growth in 2024, and if buying is on your radar, it may be worth trying to buy sooner rather than later to potentially avoid paying more.

So call Brendon Cowan today to get the ball rolling on a home loan that helps you achieve your new year property goals sooner.

Contact BrendonDisclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced or republished without prior written consent.