Borrowers hit with loyalty tax

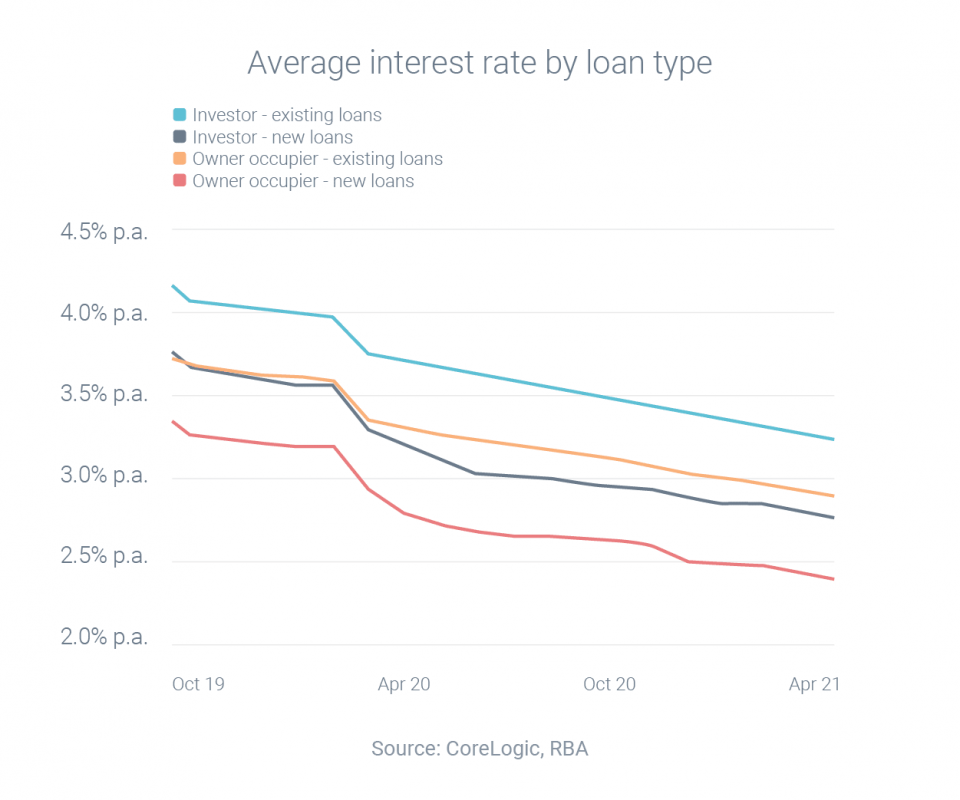

Borrowers who stick with the same lender year after year are probably being slugged with a ‘loyalty tax’, according to new data from CoreLogic.

Owner-occupiers who took out new variable loans in April were charged an average interest rate of 2.77% p.a. However, owner-occupiers with existing variable mortgages were charged an average of 3.10% p.a. – forcing them to pay a loyalty tax of 0.33 percentage points.

Investors had to pay an even larger loyalty tax, with variable loans priced at 3.06% for new borrowers and 3.44% for existing borrowers – a gap of 0.38 percentage points.

For a $500,000 mortgage, those interest rate differentials can add up to a lot of money over the life of the loan:

- You pay $31,887 less interest over 30 years with a rate of 2.77% p.a. rather than 3.10% p.a.

- You pay $37,539 less interest over 30 years with a rate of 3.06% p.a rather than 3.44% p.a.